2% County Property Tax Cut Proposed

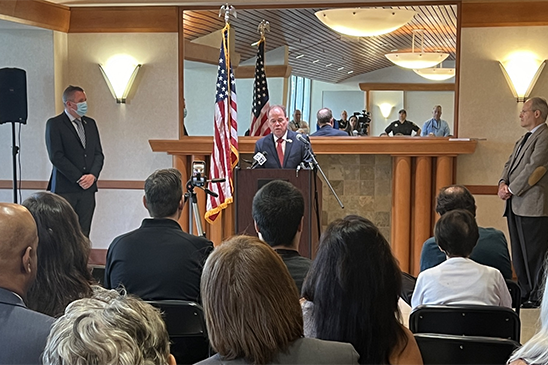

I recently unveiled my proposed 2024 $870 million budget at the Robert Yeager Health Complex in New City Monday, which includes a 2% County Property Tax cut.

This proposed cut comes on the heels of zero County property tax increases two years in a row and is a huge leap from the double-digit tax increases from years past.

The reprieve is attributed to the County of Rockland recovering from a $138 million deficit in 2014 to a surplus resulting from conservative budgeting, responsible economic growth, and hard work of county employees.

Our economic turnaround is nothing short of miraculous. I thank our dedicated employees for staying true to our commitment to conservative spending which is enabling us to absorb costs while still providing reprieve for our residents in a responsible and balanced manner.

The 2024 Proposed Budget includes:

· 2% County Property Tax Cut.

· Increasing amounts available for patriotic observances from $1250 to $3000.

· $1million for additional positions to strengthen our Department of Social Services, seeing increasing demand.

· Another $1.5 million for college tuition assistance for volunteer fire fighters and emergency medical services.

· An additional 10% in possible funding increases to nonprofit contract agencies and 224 agencies.

We have come a long way in Rockland, but I promise you this administration will not rest nor stop trying to do everything possible for the people of this county. We will continue the prudent and protective practices that have gotten us this far and work hard to preserve our County for future generations.

Budget Timeline:

· By October 1 – County Executive must submit Proposed Budget to County Legislature.

· By November 20 (tentative) – County Legislature must hold a public hearing on the Proposed Budget.

· By December 7 (tentative) – County Legislature will vote to adopt the Budget. If the Legislature takes no action by December 7, the budget is deemed adopted. If the Legislature amends the proposed budget; it goes to the County Executive for review; he has five working days after receipt of the amended version to veto. He has line-item veto power.

· By December 20 – County Legislature must override, or the amended version with any vetoes becomes the budget. It takes a two-thirds vote per veto item to override that veto (Two-thirds is 12 votes).